One of the critical factors that determines a company’s Workers Compensation insurance premium is its experience modification (E-Mod). An employer’s claims experience is compared to that of the average employer in your state(s) in the same industry within the same classification in order to predict future losses. Generally speaking, if your organization has a better-than-average loss experience, you will receive a credit E-Mod while a company with a worse-than-average experience will see a debit E-Mod.

Frequency vs. Severity of Claims

It’s important to realize that, in addition to your claims experience, the frequency and severity of those claims impact your E-Mod in different ways. Greater weight is given to claims frequency over severity. The formula accomplishes this by negatively reacting to the first $18,500 of each claim you have.

Any individual claim dollar amounts that exceed this $18,500 will have a noticeably lower impact on your E-Mod and premium (based on the relative size of your company). For every $1.00 claim dollar entering your E-Mod formula you can expect that your E-Mod will increase your premium over the three years it impacts your premium by $2.35 on average.

Let’s say Employer “A” experienced fives losses at $10,000 each totaling $50,000 while Employer “B” has had one loss totaling $50,000. In looking at these two employers, it’s statistically more likely that Employer “A” with the higher frequency of losses will incur higher Workers Comp costs in the future.

Split Rating Approach

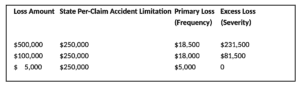

The National Council on Compensation Insurance (NCCI), which identifies and collects an employer’s payroll and loss information, develops the experience rating, and distributes it to the insurer, looks at a combination of both the occurrence and the cost of each injury. A split rating approach is applied to reflect frequency and severity of losses. Any individual loss up to the split point of $18,500 in most states is known as a primary loss, reflecting frequency. The amount in excess of this split point is an excess loss and reflects severity. In addition, there is a per-claim accident limitation amount per state (which varies, depending on the state) for experience rating purposes. Let’s say you have an individual loss of $500,000 and there is a state cap of $250,000. Anything above $250,000 would be excluded in calculating the employer’s E-Mod.

Here’s an example of how the Split Rating would work:

Loss Amount State Per-Claim Accident Limitation Primary Loss Excess Loss

As you can see, the primary losses (frequency) in the above example are weighted more heavily in the formula than the excess losses (severity) and, subsequently, will have a greater impact on an organization’s E-Mod. It’s important to note, however, that although excess losses carry less weight, they are still quite relevant as the total excess claims dollars can be significant.

In addition, the weights assigned to primary or excess losses are adjusted to ensure the E-Mod reflects an individual employer’s loss history within its classification.

Addressing Claims Frequency

There is real incentive for employers to implement measures to reduce loss frequency, as doing so will improve their E-Mod and, ultimately, the cost of their Workers Compensation program. Measures including implementing a robust case-by-case Return-to-Work plan that gets employees back to work as soon as possible, utilizing a telephone nurse triage service to connect an injured worker with the appropriate medical resources to reduce direct and indirect claims costs, and other critical programs and strategies.

The experienced Workers Comp professionals at Strong Tower can provide you with a routine analysis of your E-Mod to determine its accuracy and forecast its future financial impact on your premiums. We can also help analyze your claims history to see where safety program improvements can be made to stem loss frequency, develop a targeted Return-to-Work plan, and provide you with a telephone nurse triage service and other measures to help gain control over your Workers Comp costs. Take our quick online Intelligent Risk 365 quiz to see if you’re doing all you can to manage your E-Mod. We can be reached at 866-822-6774.